International payments are a crucial component of the global economy, enabling businesses to engage in trade, individuals to send remittances, and entrepreneurs to access global markets. However, in Africa, the landscape of cross-border payments is fraught with challenges that hinder efficiency and accessibility. This blog post delves into the complexities of international payments in Africa, and the obstacles that need addressing, and highlights five innovative startups working to transform this space.

The Current State of International Payments in Africa

Africa’s cross-border payment ecosystem is diverse but characterized by significant inefficiencies. Traditional banking systems and money transfer operators (MTOs) have historically dominated this space. While banks offer a secure method for transferring funds, they often come with high fees and slow processing times. MTOs like Western Union provide faster services but still charge high fees, particularly for smaller transfers. According to the World Bank, the average cost of sending money within sub-Saharan Africa stands at approximately 7.73%, which is notably higher than the global average of 6.35%.

Major Challenges

The challenges facing international payments in Africa can be summarized as follows:

- High Transaction Costs: The costs associated with cross-border transactions remain prohibitively high for many users.

- Regulatory Fragmentation: Each African country has its own regulatory framework governing foreign exchange and transaction reporting, complicating cross-border payments.

- Limited Infrastructure: Many regions lack adequate banking infrastructure and reliable internet connectivity, especially in rural areas.

- Currency Volatility: The presence of multiple currencies and fluctuating exchange rates adds complexity to transactions.

- Financial Exclusion: A significant portion of the population remains unbanked or underbanked, limiting their access to formal financial services.

Innovative Startups Addressing Payment Challenges

Several startups are emerging to tackle these challenges head-on, leveraging technology to create more efficient payment solutions. Here are five notable companies making strides in this area:

1. Sudo Africa

Sudo Africa focuses on providing seamless cross-border payment solutions tailored for African businesses. The platform offers multi-currency wallets that allow users to transact in their preferred currencies while ensuring compliance with local regulations. Sudo Africa aims to reduce transaction times significantly, empowering SMEs to manage their cash flow more effectively.

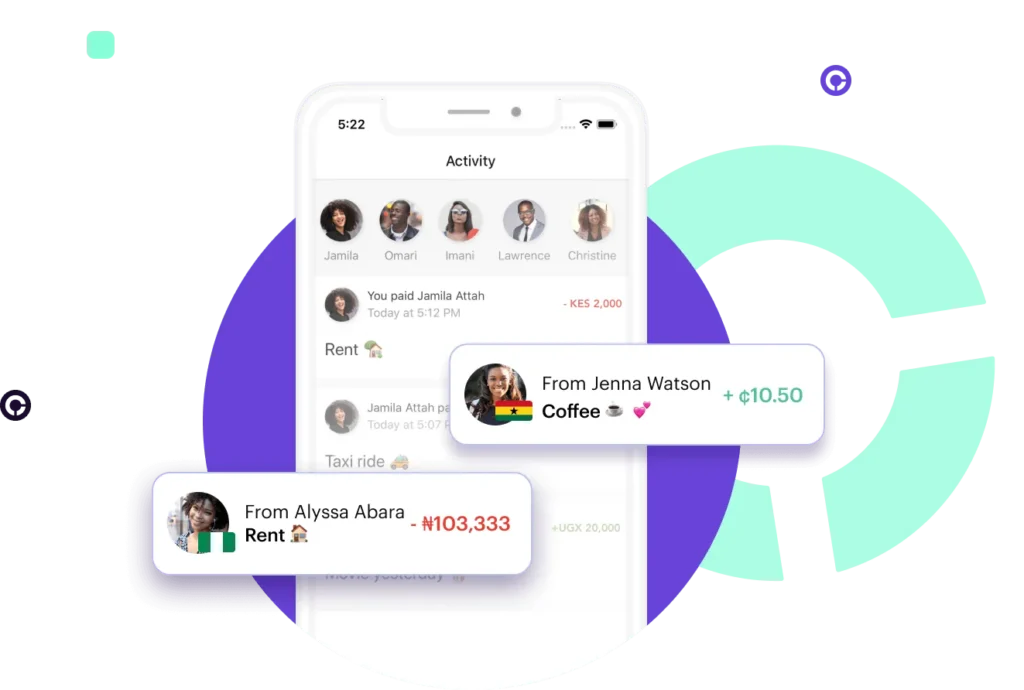

2. Chipper Cash

Founded in 2018, Chipper Cash has quickly become a leader in cross-border payments across Africa. The fintech company provides a mobile app that allows users to send and receive money across several African countries without incurring fees for peer-to-peer transactions. With over four million users, Chipper Cash operates in seven countries including Ghana, Kenya, Nigeria, and South Africa.

3. Eversend

Eversend is a Ugandan fintech that combines cryptocurrency exchange with cross-border payment services. Launched in 2019, Eversend allows users to send money across borders at competitive rates while also facilitating cryptocurrency transactions. With over 300,000 registered users, Eversend has processed millions of dollars in transactions since its inception.

4. Payday

Launched in 2021 as a neobank, Payday provides global accounts denominated in USD, EUR, and GBP for Africans living on the continent. This service enables users to receive payments from international sources easily while allowing them to withdraw funds in their preferred currency. Payday is particularly popular among remote workers and freelancers who require efficient payment solutions

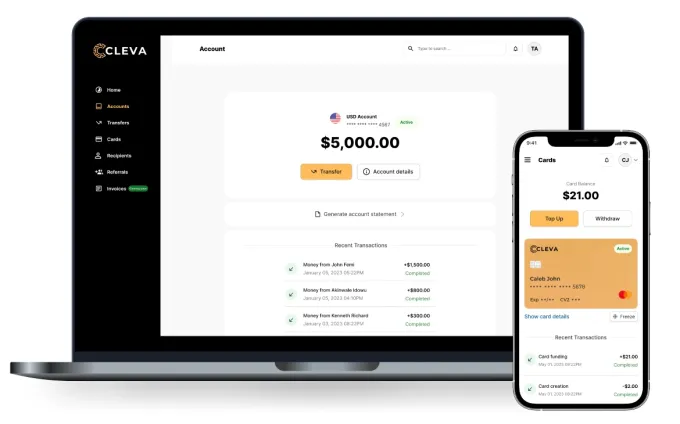

5. Cleva

Cleva is a Nigerian startup founded in 2023 that aims to simplify international payments by allowing users to receive US dollar payments directly into US-based accounts. Cleva’s platform also facilitates currency conversion and offers virtual bank cards for online transactions. With a focus on compliance and user-friendly interfaces, Cleva is poised to significantly impact how Nigerians receive international payments.

As Africa continues to integrate into the global economy, the need for efficient cross-border payment systems becomes increasingly vital. Regulatory harmonization efforts across the continent are essential in addressing the challenges that hinder these transactions. This blog post explores how these efforts impact the cost and speed of cross-border payments in Africa, highlighting the benefits of a more unified regulatory framework.

Understanding Regulatory Harmonization

Regulatory harmonization refers to the process of aligning regulations across different jurisdictions to create a cohesive legal framework. In the context of cross-border payments, this involves standardizing rules related to licensing, compliance, consumer protection, and anti-money laundering (AML) measures among African nations. The goal is to facilitate smoother transactions, reduce costs, and enhance financial inclusion.

Key Benefits of Regulatory Harmonization

- Reduced Transaction Costs: One of the most significant impacts of regulatory harmonization is the potential reduction in transaction costs. Currently, businesses and individuals face high fees due to varying regulations and compliance requirements across countries. By standardizing these regulations, economies of scale can be achieved, leading to lower costs for cross-border transactions. For example, a unified regulatory framework can streamline compliance processes, reducing administrative burdens and associated costs for payment service providers (PSPs) and users alike.

- Increased Speed of Transactions: Harmonized regulations can significantly improve the speed of cross-border payments. With standardized procedures in place, transactions can be processed more quickly, minimizing delays caused by differing national regulations. Instant payment systems (IPS) can be more effectively implemented when there is regulatory alignment, enabling real-time transactions across borders. This is particularly crucial for businesses that rely on timely payments for operational efficiency.

- Enhanced Interoperability: Regulatory harmonization paves the way for greater interoperability between payment systems across different countries. Currently, many African nations have developed their own instant payment systems; however, these systems often lack compatibility with one another. By establishing common standards and protocols through harmonization efforts, it becomes easier for different payment platforms to communicate and process transactions seamlessly. This interoperability is vital for facilitating cross-border trade and improving access to financial services.

- Boosting Financial Inclusion: A unified regulatory framework can enhance financial inclusion by making digital payment services more accessible to underserved populations. By reducing complexity and costs associated with compliance, smaller financial institutions and fintech companies can enter the market more easily, offering innovative solutions that cater to unbanked individuals. As more people gain access to affordable digital payment solutions, overall economic activity is likely to increase.

- Strengthening Consumer Protection: Harmonized regulations can also enhance consumer protection across borders. With consistent standards in place regarding data privacy and transaction security, consumers can feel more secure when engaging in cross-border transactions. This confidence is essential for encouraging greater participation in digital economies.

Challenges Ahead

Despite the clear benefits of regulatory harmonization, several challenges remain:

- Diverse Regulatory Environments: Each African country has its unique regulatory landscape, which can complicate efforts to achieve harmonization. Disparities in legal frameworks often lead to inconsistencies that hinder seamless transactions.

- Political Will: Achieving regulatory alignment requires strong political commitment from governments across the continent. Coordinated efforts are necessary to overcome national interests that may conflict with regional goals.

- Capacity Building: Many countries may lack the necessary infrastructure or expertise to implement new regulations effectively. Capacity-building initiatives will be crucial in ensuring that all nations can participate equally in harmonization efforts

The Role of Blockchain Technology

Blockchain technology is emerging as a game-changer for cross-border payments in Africa. As a decentralized ledger system, blockchain offers several advantages:

- Reduced Transaction Costs: By eliminating intermediaries, blockchain significantly lowers transaction fees. For instance, stablecoins—cryptocurrencies pegged to stable assets like the US dollar—can reduce transfer costs to as low as 0-1%, making them up to 20 times more cost-effective than traditional money transfers.

- Faster Transaction Speeds: Blockchain transactions can be completed within seconds, compared to the days required by traditional systems. This speed is crucial for businesses that depend on timely payments to manage cash flow effectively.

- Enhanced Security and Transparency: Blockchain provides a secure and transparent method for recording transactions. Once recorded, transactions cannot be altered or deleted, reducing the risk of fraud and enhancing trust among participants.

- Greater Accessibility: Blockchain technology operates independently of traditional banking systems, allowing users with internet access to participate in global commerce without the need for a bank account. This is particularly beneficial for unbanked populations in Africa.

The Impact of Cryptocurrencies

Cryptocurrencies are also playing a pivotal role in transforming cross-border payments:

- Decentralization: Cryptocurrencies operate on decentralized networks, which means they are not subject to the same regulatory constraints as traditional currencies. This allows for more fluid cross-border transactions without the delays associated with regulatory approvals.

- Increased Adoption: Countries like Nigeria have seen significant growth in cryptocurrency usage for cross-border payments, with transaction volumes reaching $56.7 billion between July 2022 and June 2023. Approximately 96% of Africa’s cryptocurrency volume is attributed to cross-border transactions, indicating a strong preference for digital assets in international trade.

- Financial Inclusion: Cryptocurrencies can provide financial services to those who are unbanked or underbanked, enabling them to engage in international trade and remittances. This can help bridge the gap between formal financial systems and informal economies prevalent in many African countries

Wrapping Up

The future of international payments in Africa looks promising as innovative startups like Sudo Africa, Chipper Cash, Eversend, Payday, and Cleva work tirelessly to address existing challenges. By leveraging technology and focusing on user needs, these companies are paving the way for more efficient and accessible cross-border payment solutions.

As the fintech landscape continues to evolve alongside regulatory harmonization efforts across the continent—such as those driven by the African Continental Free Trade Area (AfCFTA)—the potential for economic growth through improved cross-border payment systems becomes increasingly viable. With continued investment and innovation, Africa can overcome its payment challenges and fully participate in the global economy.

If you enjoyed this, follow us across all social media platforms and subscribe to our newsletter for exclusive content.